Have you driven by an auto dealer recently? Have you noticed the numbers of cars in those lots are dwindling? If you are looking to buy a new car, I have some bad news. The dealer’s lots are nearly empty. I drove by a local dealer today and noticed something interesting. To make it look like they have more inventory, the dealership actually had the cars parked front to back instead of side by side. If you are looking to purchase, these low inventories might be bad news. But it may bode well for manufacturing businesses moving forward.

New Vehicle Inventory Supply

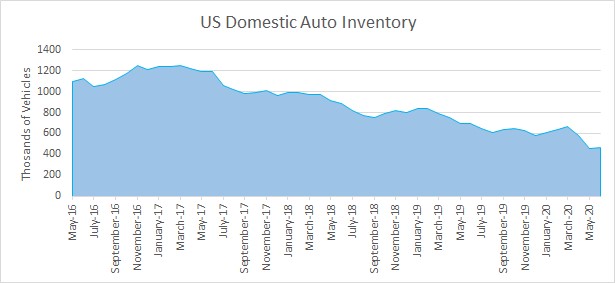

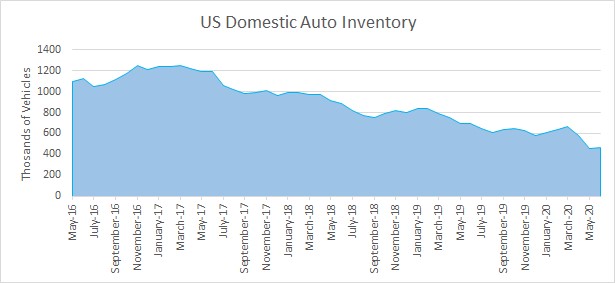

The U.S Automotive Industry was put on pause for nearly 2 months. The big three shut down in mid-March and did not resume operations until May 18th (at a reduced capacity). This, coupled with a 50-day strike at General Motors late last year, resulted in the shortage of new vehicles. According to Michelle Krebs, a senior analyst for Autotrader, new-vehicle inventories are at its lowest point in nine years. Sales will likely be limited by the low supply. As a result, auto manufacturers are ramping up their production much sooner than forecasted.

Is There a Demand for New Vehicles?

Supplies being low is only half of the equation. What about demand? This economic downturn is unique and feels very different than 2009 and even 2001. Analyst opinions are quite varied and often contradictory in predicting when and how we will rebound. I believe it all comes down to one simple question. Does the average American believe they can afford a new car? There has to be plenty of pent up demand, but I suspect most people are wondering, “Can I afford it?”

Average U.S. Consumer Finances

Economic crises usually equate to the average consumer’s finances taking a drastic hit. Not so fast, this time! According to data from Experian comparing the average American’s finances from January to May of 2020:

- Credit score is 1% better

- Total average debt is down 1%

- Average credit card balance is down 14%

- Average credit utilization rate is down 15%

- Number of delinquencies are down 6%

I was surprised to learn that American consumer finances and credit are actually better than when we entered this economic downturn. With the average consumer having available credit and pent up demand, it just might be time to buy a new car. What does this mean for manufacturing? According to the Center for Automotive Research approximately 4.5% of all U.S jobs are supported by the US Auto industry. This equates to over $500 Billion in compensation, which touches every sector of the U.S. economy, especially manufacturing. When the automotive industry is booming so are most manufacturing centric businesses.

With the short supply of vehicles and the pent-up demand of the average consumer, the manufacturing sector may return much quicker than many analysts are predicting. The question is, will you be ready for a quick rebound? Make sure your supply chain is ready to react and take the necessary steps to be prepared for full ramp up. Feel free to contact Executek Recruiting Partners at 724.550.1111 if you want to discuss leadership deficiencies, talent acquisition, or staffing strategies. We’re happy to share ideas and a phone call doesn’t cost anything. In the meantime, buckle up. I suspect we will rebound quickly. If I’m correct, it’ll be one heck of a ride back!